Just before Christmas a Fianna Fáil Bill was presented to the House dealing with transparency into the activities of NAMA. However, the proposal not surprisingly was voted down by Fine Gael and Labour, no doubt not wanting to have anything as inconvenient as truth and transparency get in the way of serving their masters in Germany and the ECB. You don’t get to be best boy in class by drawing attention to the bad teachers.

In the course of the discussion Brian Ó Domhnaill TD told the House that two senior officials now on the NAMA payroll had been involved in the HSBC violations of anti-money laundering regulations which ‘may have’ facilitated the receipt and laundering of billions of dollars from drug cartels from Mexico and Columbia. Allegedly the amount involved was in the tens of billions over a decade and a substantial amount was money being laundered on behalf of two state controlled Iranian banks.

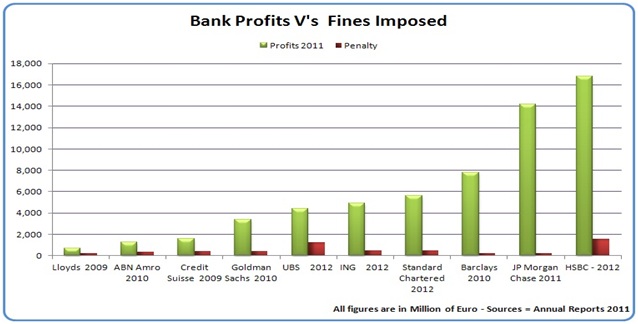

Last week HSBC agreed to a record settlement of €1,600million with the US financial regulators and was done so without recourse to the law. This figure we can assume, is supposed to discourage future such ‘transgressions’. You will notice that I did not say ‘fine’ or ‘offence’ or even suggested that any laws were broken. Well, we will never know because the US Justice Department decided against a criminal prosecution as they deemed HSBC simply too big to prosecute. You couldn’t make this up! They maintained that in the event of a successful prosecution it may have had ‘collateral consequences’. By this they were referring to possible penalties which could have included a ban on HSBC operating in the USA and this would have led to massive job losses among the ranks of its banksters and we can’t be having that, can we?

Last year, in the UK alone, sixty five of these HSBC banksters were paid over €1.2million each, the bank itself made a profit €16,800 million in 2011 (over four of our 2013 budgets) while the present CEO Stuart Gulliver was paid €7.2million. The man who was running the show at the time of the ‘mistakes’, Lord Stephen Green, who was on similar remuneration, was awarded a peerage and position of Trade Minister two years ago and presently is a banking advisor to the British Chancellor of the Exchequer George Osborne, as well as being a member of the Cabinet Committee on banking reform.

In 2009, UBS paid €600million to the US regulatory authorities following an investigation which showed that the bank ‘may’ have assisted wealthy Americans engage in tax evasion. By admitting that they had, the bank got a financial slap on the wrists and that was all. Before Christmas we learned that the bank had been hit with a Eur1,250million ‘fine’ in order for rigging the LIBOR interest rate over a period of years, in collusion with at least half a dozen other banks. This is the rate which affects how much you repaid on your credit card or loan account. Still, last year they paid out Eur2,800million in bonus’s to their bankster employees.

A few weeks ago shares in Standard Chartered, the UK’s second largest rose after it agreed to pay €251 million to settle accusations that between 2001 and 2007 it hid information from regulators relating to at least Eur192,000million in direct contravention of regulations which placed sanctions on transactions with Iran, Burma, Libya and Sudan during that period. Problem solved.

So, what has all this to do with the price of cabbage, I hear you ask? Well, I am no detective but financial crimes are no different from others insofar as those you actually detect are a very small percentage of the crimes being committed. Where financial crimes do differ and massively so from other crimes is that you can just buy your way out jail, with the proceeds of the crime you just committed! Try that after robbing the local Post Office.

Seriously, HSBC might as well have paid their paltry fine with a few kilos of cocaine instead. Or, offering to slaughter a few Mexican drug dealers from a rival gang. Morally and ethically, there is absolutely no difference between that and laundering drug money. HSBC were a king pin and enabler in the drug business for years. Yet, they were not prosecuted on any criminal grounds. Go figure.

Since June 2006, Ireland’s central bank has sanctioned 50 financial companies resulting in €18.5m in fines and nine disqualifications for various other violations. Most of the fines – €11m – have been imposed since the creation of the enforcement directorate. (FT 21-06-2012)

UBS’s Life Insurance division in Ireland were hit with a €65,000 (yes, that’s a paltry 65 thousand!) in June 2012. “This is serious to us and we want boards of directors to pay attention,” said Peter Oakes, who is the head of Central Bank of Ireland enforcement directorate. Considering that UBS wrote €688m in gross premiums during 2011 I would say they got off pretty lightly indeed.

Two individuals in England weren’t so lucky. They were sentenced at Croydon Crown to eight years each for money laundering offences and 24 years each for drug trafficking offences in 2010. Martin Brown, Assistant Director of Criminal Investigation for HM Revenue & Customs (HMRC) said: “HMRC investigators were able to … prove their involvement in criminal activities worth millions of pounds. These sentences make it clear to those tempted to launder money, or get involved in the illegal drugs trade, that they are taking a serious risk.” But obviously only is you are a private and not corporate criminal it would seem. HSBC were involved in laundering thousands of millions in drug money, ‘allegedly’ and yet no charges, at all!

The facts are as simple as they are stark. The idea, that these educated grossly overpaid greedy banksters who inhabit the business of international finance can be trusted, is pathetic. It is time for some real regulation. I would suggest that a prescribed number of offences carry a minimum mandatory prison sentence of ten years for the department head within the offending bank. No ifs, no buts, no maybes and definitely no financial only ‘settlements’.

The issuance of all money in circulation by privately owned banks (through the creation of interest bearing debt) must be stopped and the power once again invested in the State. Alas, this is a root of all financial trouble in the world and I shall address it shortly in another article..

People often accuse me of being a conspiracy theorist when I say that there is a ruling elite who are not only above the laws, they make them. Well, to quote Clint Eastwood “don’t piss down my back and tell me it’s raining”. The facts above speak for themselves because right now, only people without wealth need fear the law.

Eamon

congrats on another insightful article. Looking at Mr Greens career since leaving the bank, it seems only a matter of time before we see the “bauld Nidge” in a more suitable position such as Irish Minister for Health.

However I would like to make one small point. Comments such as

“Still, last year they paid out Eur2,800million in bonus’s to their bankster employees”

and

“these educated grossly overpaid greedy banksters who inhabit the business of international finance”

are nothing short of trite rabble rousing generalisations. Unfortunately, this is not the first article in which you have tarred all employees of Banks with the same brush. You appear to have fallen into some of the worst of the bad habits exhibited by the gutter press, namely;

– Throw enough Shit and some of it’s bound to stick.

– If you shoot a big enough gun you’ll eventually hit your target and who will really care if there’s bucketloads of collateral damage along the way.

(Yeah – I know – I can do it too !!)

You and all the other media commentators out there need to take the time to distinguish between the thousands of ordinary decent people who are employees of banks and the corrupt decision makers at the top who have brought the economy to its knees.

The vast majority of bank staff in this country face the exact same hardships as every other person with a family and a mortgage. They do not get bonuses, and haven’t had an increase in wages in 5 years. In fact many are earning significantly less than they were in 2007. They are also subject to even more stringent financial controls than the customers they deal with on a daily basis.

So please, next time around, don’t sully your otherwise excellent work, with the type of populist generalisations that have already led to people being physically attacked in the streets by strangers, purely because of the colour of their suit / shirt / uniform.

For what it’s worth; if you are supplied with a uniform by a Bank, the chances of you having the authority to do anything other than what you’re told (if you want to keep your job) are miniscule.

Dec

Brilliant article and very well researched. Is anyone listening ? I fear not. Those who already know the facts created them with impunity, those whom they adversely affect bleat from the pen before munching inanely on the sheeple-cack thrown in to them. Attempting to get anyone to put their asses where there mouths are is, in Ireland, an infuriatingly futile task . I’ve been trying for over a decade within disability and people will still not put their faces to their moans….which will still be heard droning as they shuffle towards the stun-gun.

Very accurate – the banks can do what they like and not be held to account (in a realistic way). The Irish people do not want to know about corruption, and they do not want to deal with it. As long as they have their bread and games, as the romans used to say, they will not revolt. Inflation has arrived, and will one day become so bad that the majority of the people will not be able to afford the basics. The rich themselves will also not escape the results of our system. The only ones to escape the consequences will be the bankers servants, ie the politicians, and other servants such as the Gardai, and other public servants who are necessary for the effective control of the masses. Bankers’ will also protect their other private servants such as the national and local newspapers and the staff in those newspapers who can continue the lies fed to the Irish people to control them. Will be have a revolution in Ireland before the centenary of the 1916 revolution?